Things You Need To Know About Selling a Deceased Estate Property

Essential Factors To Consider When Selling The Real Estate Of Your Deceased Loved One

After the death of a loved one, such as a parent, there are avariety of tasks that must be handled to wrap up your loved one’s final affairs. Selling your deceased loved one’s real estate is one of the more daunting ones. But before you call a real estate agent, you should take some time to get familiar with and consider a few of the key issues as you work through this process.

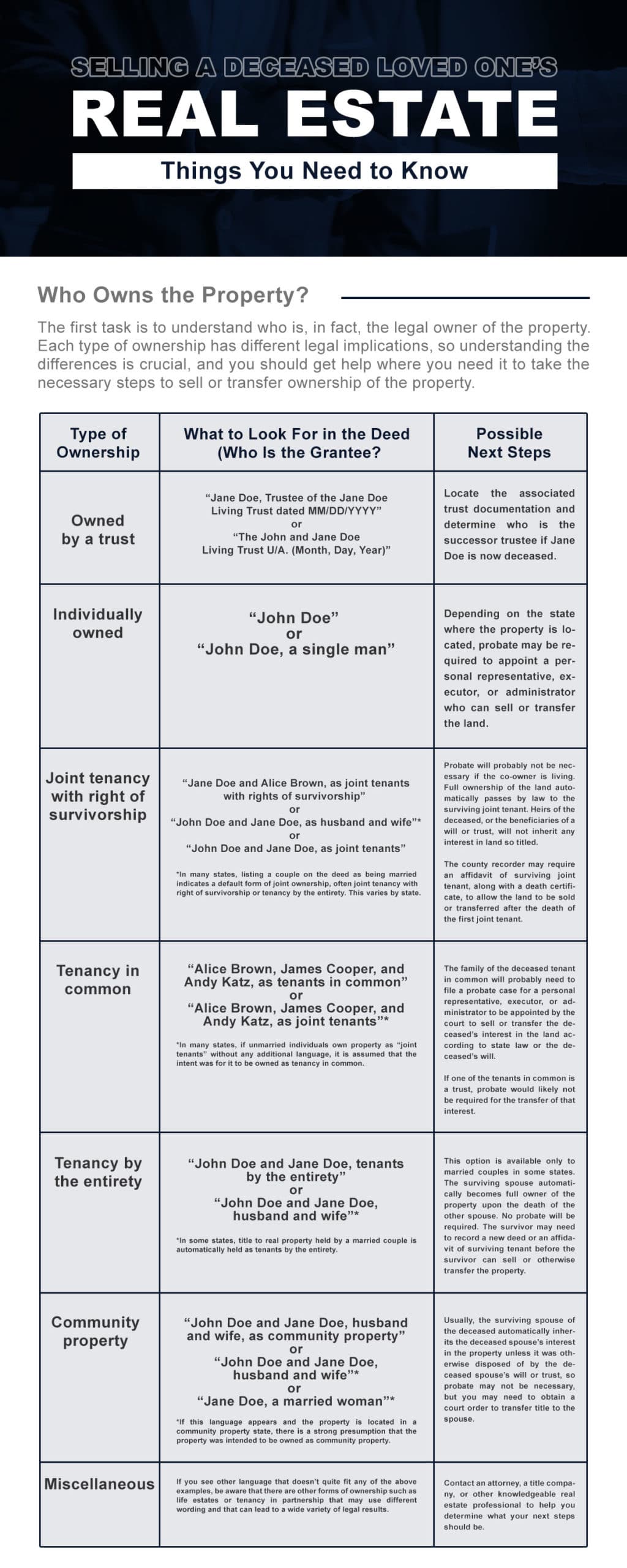

Understanding Who Owns The Property After The Owner Dies

The first task is to understand who is, in fact, the legal owner of the property. Many families are surprised to learn that their family member was not the legal owner of the house where the relative had lived for years. Perhaps the family member was renting all along or owned the home jointly with another relative or a friend.

How do you find out whether your loved one was the actual owner? You must locate and examine the last vesting deed for that property. “Vesting” means that the ownership has become genuine and legal. The deed (the legal document that creates ownership of the property) contains the information needed to determine ownership of the land. When someone takes title to property, the previous owner signs a deed. Then the deed is recorded with the regional government office, often called the recorder, that keeps track of land ownership. In most cases, a deed must be recorded before the land will vest in the new owner. If you cannot find a copy of the recorded deed among your loved one’s important papers, you may need to go to the city or county recorder’s office, a title company, or a Mesa estate planning attorney with experience in real property transactions to get help searching for the deed in the property records and determining whether your loved one owned the property.

Once you have located the recorded deed, you will see the type of legal ownership. Each type of ownership has different legal implications, so understanding the differences is crucial, and you should get help where you need it to take the necessary steps to sell or transfer ownership of the property.

Property Appraisal After Your Loved One’s Death

It is a good idea to have the property appraised as soon as possible after your loved one’s death. An appraisal is beneficial for a variety of reasons:

- If you sell the property to a family member or a friend, or even if you choose to purchase the property yourself, a professional appraisal will protect you as the trustee, personal representative, or executor should other heirs and beneficiaries claim that you sold the property in a self-dealing manner for less than full market value.

- If you sell to an unrelated third-party purchaser, an appraisal will help you determine whether you are getting a fair price for the real estate and protect you from accepting low-ball offers. It will also protect you as the trustee, personal representative, or executor from claims that you are not acting in the best interests of the beneficiaries.

- If your loved one’s estate could be subject to estate taxes, an appraisal will help you verify the value of the estate for tax purposes.

- If you intend to sell the property later, an appraisal will help you determine the new tax basis of the property, established upon the death of the previous owner, so you can accurately calculate the capital gain or loss when you ultimately sell the property.

- Documenting the proper value of the property can also help with obtaining insurance sufficient to cover any damageto the property while you are administering your loved one’s estate or trust.

Maintaining The House Until It Is Ready To Be Sold

When you are handling the final affairs of a loved one, properly maintaining the property until it is ready to be sold is another important task. For instance, you must determine if the property still has a mortgage against it and whether there are sufficient funds in the estate or trust to continue making mortgage payments. If not, you could risk foreclosure, which can exponentially complicate your job.If funds are available, you should ensure that timely payments continue to be made.

In addition to maintaining any mortgage payments, you should also make sure that the property taxes and any other necessary payments such as water, electricity, natural gas, yard maintenance, security system, etc., are timely paid. With respect to phone, internet, and cable bills, you should determine whether those are necessary. Certain alarm systems require a phone line or internet connection to function properly.

A Seller’s Required Property Disclosures

Once you have listed the property for sale, you must be sure that you know what disclosures about the property the applicable laws and regulations require. In some states, you are required to disclose a variety of property conditions to potential buyers. Failing to do so can expose you to significant liability and even litigation in some cases. Some of the more common disclosures you should be aware of include

- asbestos, mold, water damage, or lead;

- mechanical or electrical problems or issues;

- structural problems;

- hauntings or deaths that occurred in the home, including natural deaths, murders, or suicides;

- boundary disputes;

- environmental and natural hazards, such as high radon levels, contaminated soil, electrical hazards, high water tables leading to frequent

- flooding, etc.; and

- drug-related hazards, e.g., meth labs.

Check with your real estate agent or your Mesa estate planning attorney to determine what disclosures are required under state law.

Contact Professional Estate Planning Attorneys In Mesa, AZ

Selling the property of your loved one does not have to be overly complicated, and it can often be done very quickly and efficiently. Now that you are armed with the above information, you will be far better prepared to handle this important aspect of your loved one’s final affairs. Call Gunderson Law Group, P.C. if you need help, we welcome the opportunity to visit with you about your specific needs. Contact us today.

Approved and published by Adam Gunderson

Arizona Location

1839 S Alma School Rd #275

Mesa, AZ 85210

Office: (480) 750-7337

Email: Contact@GundersonLawGroup.com