Client Testimonials

Mesa Estate Planning Attorneys With 5-Star Reviews

Adam Gunderson was very open, professional and friendly. I enjoyed how prompt he was with his email replies to my questions. I will not hesitate to work with him again, once the need arises.

E. A. ★★★★★

Very Happy with the level of service received. Adam and the whole staff we polite, professional and knowledgeable I highly recommend.

C. C. ★★★★★

They are always there when you need an advice. Thanks to Debbi and Adam. Great service!

M. V. ★★★★★

Why You Need An Experienced Estate Planning Lawyer

Creating an estate plan can be time consuming and complex. Our lawyers can make sure your plan covers every aspect of your estate including properties, businesses, assets and more so that you can have peace of mind.

Ensure legal compliance

Help avoid family disputes

Reduces tax liabilities

Avoid probate and unnecessary legal battles

Personalized Estate Planning Strategies For Your Peace Of Mind

Drafting A Last Will

& Testament

Nobody knows when they are going to pass and it is important to have some form of a last will and testament. It can be difficult to know where to start which is why our lawyers are available to help you create a draft that is tailored to your specific situation.

Creating A Power

Of Attorney

To avoid a court-appointed conservatorship, make sure you have established a power of attorney by reaching out to our team! We can help you determine who would be the best fit and will work through the paperwork with you to make it legal.

Comprehensive Probate & Estate Administration Services

Settling an estate through probate can be time consuming and confusing. Let our estate planning lawyers stand by your side and give you peace of mind as you navigate court filings, creditor claims, and asset distribution.

Asset Protection &

Tax Planning

Our lawyers are trained and highly skilled at ensuring your estate is structured in such a way that reduces tax liabilities and protects from creditors or lawsuits. Our goal is to create a plan suitable for your specific situation that secures wealth for future generations.

Developing Revocable Living Trusts

If you are wanting to create a revocable living trust, reach out to our lawyers today. We will work with you to create and draft your revocable living trust to ensure that your assets are protected, but you’re still able to manage, modify, or revoke the trust.

Preparing Healthcare Directives & Living Wills

Ensure that your health is protected every step of the way by having our lawyers draft healthcare directives and living wills. We will walk you through choosing the appropriate healthcare advocate and make sure you get top notch treatment.

Advanced Estate Planning Services In Mesa

Establishing

Charitable Trusts

If you’re looking for ways to gain certain tax advantages while also giving to a cause that you care about, consider hiring our lawyers to plan a charitable trust! You can leave a lasting legacy behind while also benefiting from financial benefits.

Managing Dynasty Trusts & Family Wealth Planning

Managing wealth and passing it down from generation to generation can be challenging, but with the right trust put into place, it can happen! Rely on our lawyers to make sure your assets are protected and future generations can benefit.

Setting Up Intentionally Defective Grantor Trusts (IDGTs)

Minimize estate taxes, grow your assets tax-free, and preserve your wealth for future generations by working with our lawyers to set up an Intentionally Defective Grantor Trust. Contact us today to set up a consultation!

Developing Spousal Lifetime Access

Trusts (SLATs)

Protect your wealth, reduce estate taxes, and provide financial security for your spouse by working with our lawyers to create a Spousal Lifetime Access Trust. Our experienced lawyers will make sure to maximize tax benefits while keeping assets accessible.

Providing Expert Guidance To Simplify Inheritance Planning

Our team has in-depth experience in handling matters related to inheritance such as probate, estate settlement, and trust administration. If you’re unsure how to move forward, you can be sure that the experts on our team at Gunderson Law can help.

Business Succession Planning For Entrepreneurs

Our lawyers will work with you to structure a succession plan, create buy-sell agreements, minimize taxes, set up trusts for your business assets, and more. Don’t wait to get started, reach out to us today to secure your business’ future.

Ways Our Mesa Estate Planning Attorneys Assist You

Having any form of wealth can create concern about what will happen to it after you die. Estate planning can provide peace of mind in this area. Our skilled lawyers will ensure your plan adequately protects your assets, minimizes taxes, and creates a smooth transfer to the beneficiaries.

Your lawyer can draft all of the essential documents such as wills, trusts, power of attorneys, and healthcare directives. They can help you avoid probate by structuring a trust and in the event where probate is inevitable, they can walk you through the process. Not only that, but for high-net-worth individuals, our lawyers are skilled at putting together dynasty trusts, spousal lifetime access trusts, and more. Reach out to our law firm today to see how we can help you.

Flexible Payment Plans For Mesa Residents

Full Representation

(Traditional)

For traditional full representation, our lawyers will help you create an estate plan from start to finish and will charge you for the work that is completed by hour. This ensures that every detail is taken care of and if anything more comes up, we will handle it.

Full Representation

(Fixed Fee)

If you have a specific budget, consider consulting with our lawyers to establish a fixed fee for the work that you want to accomplish. In this case, you know how much you will spend for the services our lawyers will provide.

Unbundled Legal

Services

Reach out to our lawyers for the specific tasks that you need such as setting up a trust, drafting a will, or advising on probate matters. This more affordable payment option can ensure you get legal help without the costs of full representation.

Understanding Estate Planning In Mesa

Estate Planning Needs At Every Stage Of Life

Regardless of how young or old you are, estate planning is a wise idea. However, your needs will be different at each stage. Young adults might benefit from a basic will, a power of attorney, healthcare directives, and beneficiary designations. As individuals get into their middle age, our lawyers suggest creating a more comprehensive will and possibly a trust. At this age, children may be involved so guardianship and life insurance planning could be helpful as well. In old age, it is wise to finalize trusts and create a plan for long-term care.

How To Avoid Common Estate Planning Mistakes

There are many mistakes that people make when creating an estate plan. Some people fail to have a will or a trust. Others choose the wrong executor or trustee. Still others overlook tax implications. All of these situations and more can be avoided by reaching out to our skilled estate planning lawyers who will walk you through every step of your estate plan to make sure you are set up for success. Our goal is to provide you peace of mind knowing that you, your assets, and your family’s future is protected.

Choosing The Right Estate Planning Lawyer In Mesa

Finding the right Mesa estate planning lawyer may sound overwhelming, but it is key to the success of your estate plan. Check reviews and reach out to friends for recommendations. At Gunderson Law Group, we have 5 star reviews across every platform and are rated one of the top rated estate planning lawyers in the area. Schedule a consultation with us to discover how we can benefit you and create a strong estate plan tailored to the specifics of your situation.

FAQs About Mesa Estate Planning

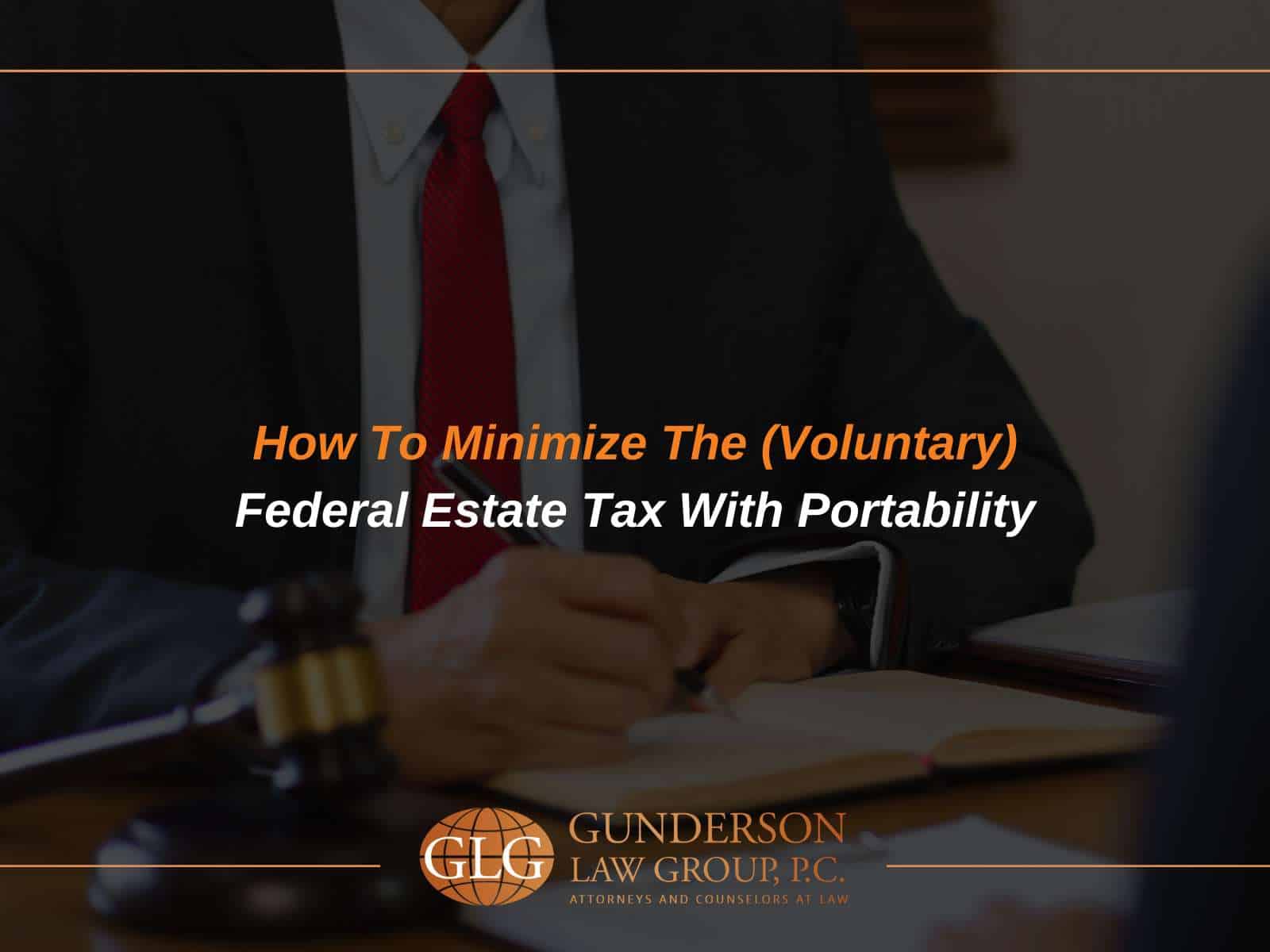

Visit Our Estate Planning

Law Office Near Mesa, AZ

1400 E. Southern Ave. Suite 850

Tempe, AZ 85282

Related Estate Planning Posts By Gunderson Law Group

5 Easy Tips to Simplify Your Charitable Giving

5 Easy Tips To Simplify Your Charitable Giving Will you be donating to charities this year? The Internal Revenue Service [...]

Estate Planning Strategies To Protect Your Spouse

Estate Planning Strategies To Protect Your Spouse You found the love of your life, and as you have built your [...]

How To Minimize The (Voluntary) Federal Estate Tax With Portability

How To Minimize The (Voluntary) Federal Estate Tax With Portability Most people may be surprised to learn that the federal [...]

Contact Us: Schedule Your Estate Planning Consultation Today

1400 E. Southern Ave. Suite 850

Tempe, AZ 85282

Monday – Thursday 9am-5pm

Friday 9am-4pm

DISCLAIMER: Do not send any confidential or sensitive information without first speaking to one of our attorneys and receiving confirmation that the appropriate conflict checks have been cleared and the firm determines that it is otherwise able to accept the engagement. Any information or documents sent prior to receiving such confirmation cannot be treated as confidences, secrets, or protected information. Submitting information through this website does NOT automatically create an attorney-client relationship.